Understanding the Basics of Short Sales

If you've ever heard the term "short sale" and wondered what it really means—or whether it can benefit you as a homeowner or homebuyer—you're not alone. Short sales are more common during times of financial stress, rising interest rates, or declining home values. But even in healthy markets, they can offer opportunities for both sellers and buyers when handled correctly.

A short sale happens when a homeowner sells their property for less than the total amount they owe on their mortgage, and the lender agrees to accept that lower amount as full payoff. In other words, the home is "short" of the amount needed to fully satisfy the loan.

This comprehensive guide breaks down exactly what a short sale is, how the entire process works, what you should expect along the way, and whether this option makes sense for your unique situation.

Quick Definition

A short sale occurs when a home sells for less than what's owed on the mortgage, with lender approval to accept the shortfall as full payment.

When Do Homeowners Consider Short Sales?

Financial Hardship

Struggling to make monthly mortgage payments due to job loss, medical bills, divorce, or unexpected life changes that impact income stability

Underwater Mortgage

Owning more than the home is currently worth in today's market, making it impossible to sell traditionally and pay off the loan.

Need to Relocate

Must move for work, family, or other urgent reasons but can't afford to cover the remaining mortgage balance out of pocket at closing.

Avoiding Foreclosure

Seeking to prevent the severe credit damage and legal consequences that come with foreclosure proceedings.

Why Would a Lender Approve a Short Sale?

It may seem unusual that a bank would willingly accept less money than it's legally owed, but short sales can actually save lenders significant time, legal fees, and the considerable hassle of foreclosure proceedings.

Foreclosure is an expensive, lengthy process that typically results in even greater financial losses for the lender. Between legal costs, property maintenance, real estate commissions, and potential vandalism or deterioration of vacant properties, banks often recover less through foreclosure than they would through a negotiated short sale.

A lender is more likely to approve a short sale when the homeowner demonstrates genuine financial hardship, provides complete documentation, cooperates fully throughout the process, and when the property's current market value has declined significantly.

"Short sales are often a 'best of bad options' scenario for lenders—they minimize losses while helping homeowners avoid the devastating impact of foreclosure."

The Short Sale Process: Step by Step

A short sale is more complex than a traditional home sale because the lender must approve everything, including the final price and terms. Understanding each phase helps set realistic expectations.

Demonstrate Financial Hardship

Submit comprehensive documentation including hardship letter, bank statements, tax returns, pay stubs, and proof of financial strain to the lender for review.

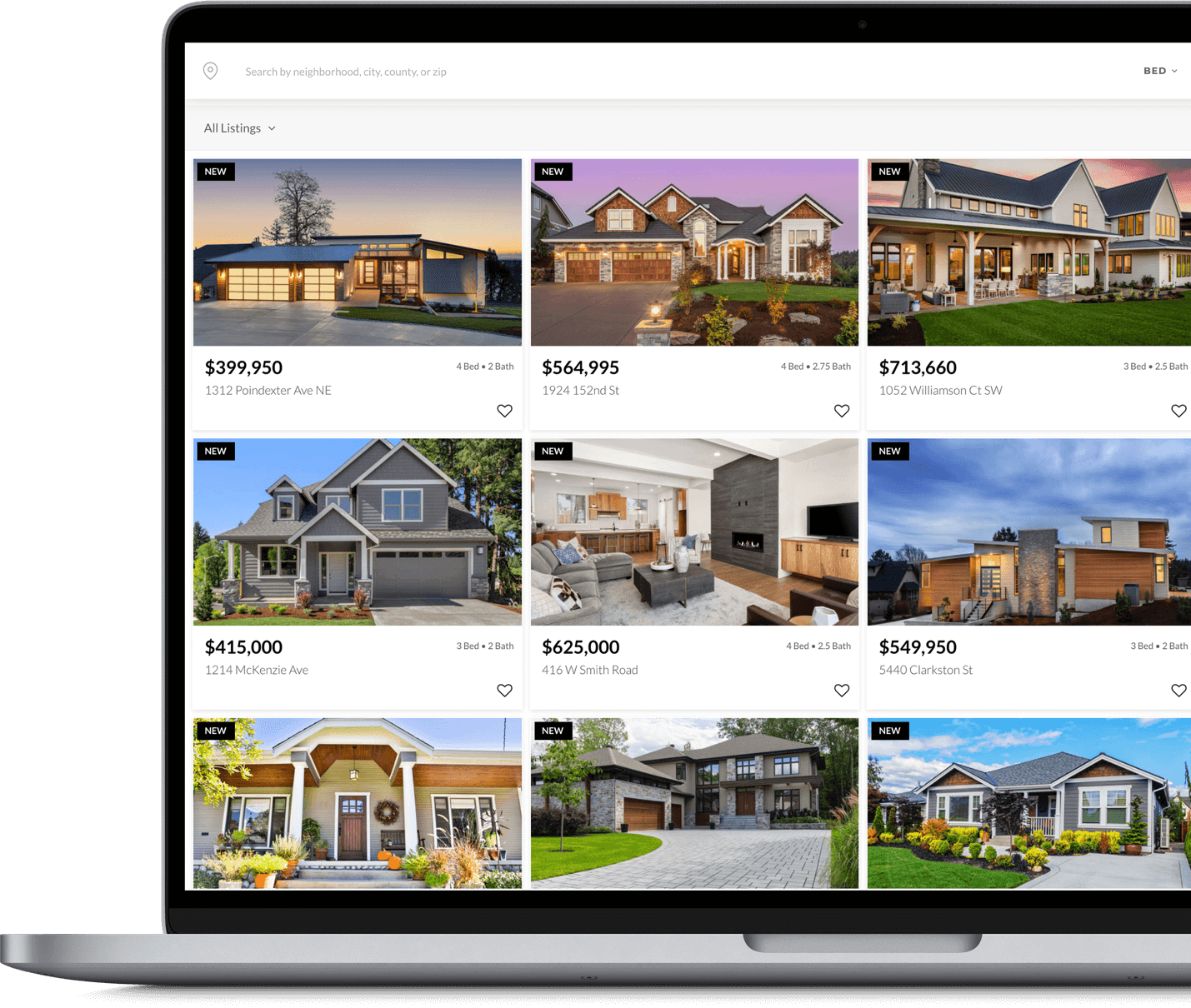

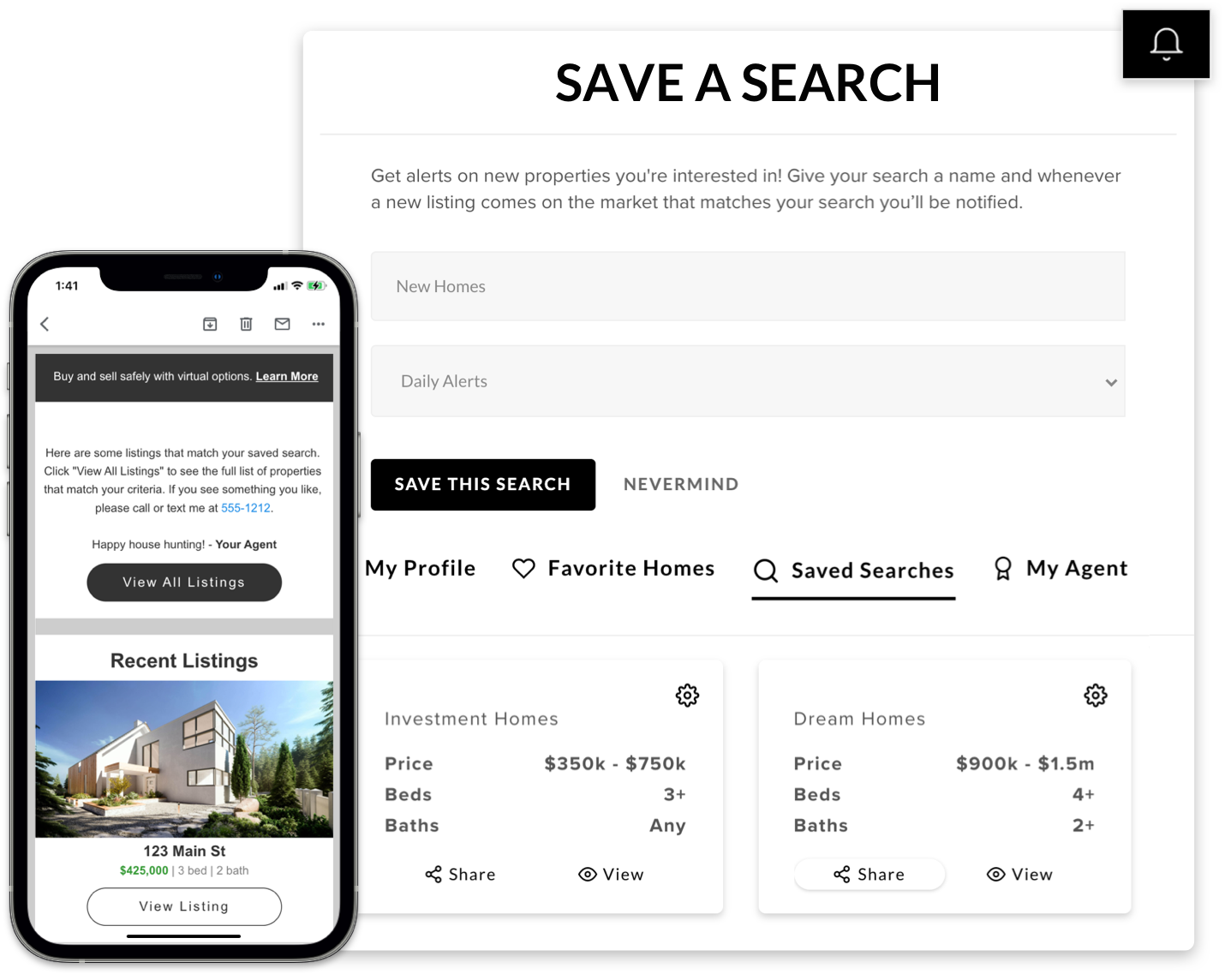

List the Property for Sale

Work with an experienced agent to price competitively based on current market conditions and begin marketing to potential buyers.

Receive and Accept Buyer Offer

When a qualified buyer submits an offer, the seller accepts it conditionally—but nothing becomes official until lender approval.

Lender Reviews the Offer

The bank evaluates the offer price, seller's hardship, market conditions, and net proceeds—this is typically the longest phase of the process.

Move to Closing

Once approved, proceed with title work, inspections, appraisals, and closing—the lender receives the agreed amount and releases the lien.

Timeline Expectations for Short Sales

The entire short sale process typically takes 3–6 months from start to finish, with lender review being the most unpredictable phase. Patience and realistic expectations are essential for both buyers and sellers navigating this complex transaction type.

Benefits of Pursuing a Short Sale

For Sellers

Prevent the severe legal and financial consequences of foreclosure proceedings, including potential deficiency judgments and court involvement.

While still damaging, a short sale typically has less severe impact on credit scores compared to foreclosure—often 50-150 points less.

Qualify for a new mortgage sooner—potentially in 2-4 years versus 5-7 years after foreclosure, depending on loan type and circumstances.

Ability to relocate sooner, start fresh financially, and avoid the emotional stress of prolonged foreclosure proceedings.

For Buyers

Opportunity to purchase properties at competitive prices, often 5-15% below comparable homes in traditional sales.

Fewer buyers willing to navigate the longer timeline means less bidding war pressure compared to standard listings.

Unlike many foreclosures, short sales often allow buyer inspections and some negotiation on needed repairs.

Making An Offer And Closing

We're With You Until The End

When you find a home you love, your agent will help you submit an offer. We are skilled negotiators that know how to get you the best price and value possible. Once an offer has been accepted we'll help you navigate through inspections, appraisals, and closing in a stress free way. You can rest assured that your agent is always acting in your best interest with a dedicated buyers agreement in place.

Then it's time to get the keys, throw a housewarming party, and make lasting memories in your new home. We're so happy that you trusted us to help you through this exciting process.